These are worrying instances for Claire Tasker’s jewelry enterprise. With hovering dwelling prices placing acute stress on households throughout the nation, the Hertfordshire-based goldsmith has seen first-hand how shoppers are reducing again.

“If folks haven’t acquired cash to spend then it’s gadgets like mine they’re probably not going to consider shopping for any extra,” says the small enterprise proprietor, who sells her handmade superb jewelry from her house studio in Hitchin.

It’s not solely that gross sales are underneath stress. The price of gold, silver, copper and gems used to make her wares has risen dramatically, too.

“I can’t see it getting any higher,” Tasker says. “The price of dwelling is affecting me, too. There’s the stress of attempting to generate profits, and it’s worrying being self-employed. You don’t have a gentle earnings.”

What Tasker is experiencing in Hitchin is a microcosm of the broader economic system. Inflation has been rising since final summer time and there have been already indicators of the post-Covid restoration faltering even earlier than Vladimir Putin ordered his troops into Ukraine. The economic system expanded by solely 0.1% in February and retail gross sales fell by greater than anticipated in March.

In April, value of dwelling pressures intensified. The typical vitality invoice has elevated by £700 a 12 months; Rishi Sunak has raised taxes; motoring prices have gone up. The most important squeeze on dwelling requirements for the reason that Nineteen Fifties has resulted in shoppers changing into gloomier and much much less prepared to spend within the retailers.

So far as consultants are involved, the query just isn't whether or not the economic system will decelerate however whether or not it's time to begin mentioning the R phrase: recession. David Blanchflower, a former member of the Financial institution of England’s financial coverage committee, is in little question. “Every bit of proof means that recession is coming,” he says.

The prospect of the UK struggling two consecutive quarters of adverse output – the technical definition of a recession – was actually not thought-about possible by the Workplace for Funds Duty (OBR) when it ready the forecasts for the chancellor’s spring assertion. Whereas noting the headwinds dealing with shoppers, the OBR mentioned development can be 3.8% this 12 months. The Worldwide Financial Fund’s newest world financial outlook predicted development of three.7% – the joint-strongest within the G7 group of industrialised nations.

The OBR and the IMF forecast a marked slowdown in 2023 however the dangerous financial information has arrived prior to anticipated. Even economists much less gloomy than Blanchflower settle for that the dangers of a recession have risen in latest months. Deutsche Financial institution says the chances of an financial downturn now stand at shut to 1 in three. With inflation prone to stay increased for longer, the stress on households to retrench will improve over the summer time. For a lot of shoppers it would really feel like a recession even when the official information says in any other case.

If the economic system does slip into recession, the Treasury and the Financial institution of England might be blamed for making coverage errors. A Treasury spokesperson mentioned: “We’re persevering with to help the economic system now. We’re offering a £22bn package deal to ease pressures on households this 12 months and serving to companies, together with by a tax lower price as much as £1,000 for half one million small companies.”

Rachel Reeves, the shadow chancellor, says Sunak blundered by not doing extra in his spring assertion to defend shoppers from the financial storm that was coming.

“The UK economic system has already been put by the wringer by the chancellor’s failure to spice up companies and set out an actual plan for development. Now we're one other 12 months of falling dwelling requirements and paltry development,” she mentioned.

Labour is asking for the federal government to carry an emergency finances to go off the mounting financial dangers. With native elections this week, the hovering value of dwelling may include a heavy worth for the Conservatives. Reeves mentioned feedback made by Sunak that it was “foolish” to count on extra help confirmed the celebration was out of contact.

“We're the one main economic system elevating taxes on folks within the midst of a value of dwelling disaster and that may be a selection that may make circumstances far worse for households already feeling the crunch.”

The Treasury rejects the cost that it has been asleep on the wheel, stating that funding might be boosted this 12 months by the super-deduction tax break, and that the spring assertion included tax breaks and a lower in excise obligation for motorists. Even so, Sunak’s reputation has waned as the price of dwelling disaster has deepened.

Shopper spending could possibly be propped up by greater than £200bn of financial savings constructed up by households within the pandemic. Nonetheless, the financial savings glut was principally concentrated among the many prime 40% richest in society, whereas lower-income households misplaced cash. Whereas common wages should not anticipated to maintain tempo with inflation, these within the public sector and precarious zero-hours jobs are anticipated to lose essentially the most floor this 12 months.

The Financial institution of England’s financial coverage committee is predicted to reply to an annual inflation fee of seven% – the best in 30 years – by this week elevating rates of interest for a fourth successive assembly. The Metropolis expects a quarter-point improve on Thursday to 1% – the best stage since instantly after the 2008 monetary disaster.

The Financial institution needs to forestall persistently excessive inflation from taking root however economists warn there's a danger that rising borrowing prices will add to the issues dealing with enterprise and households when the economic system is already faltering. Of the 5 tightening cycles within the UK for the reason that late-Seventies, 4 led to recession.

“By specializing in containing any second-round results on wages and costs, the Financial institution dangers tipping the economic system into recession,” mentioned Paul Dales, the chief UK economist on the consultancy Capital Economics. Though he expects Threadneedle Road to lift rates of interest to as excessive as 3% by 2023, a extreme downturn may pressure it to maneuver extra slowly.

“A light recession and/or modest fall in home costs might not deter the Financial institution an excessive amount of if worth pressures stay sturdy. But when the economic system and/or housing market is weaker than we count on, the Financial institution might not elevate rates of interest as far,” he mentioned.

Stephen King, a senior financial adviser at HSBC, mentioned central banks had been caught out by rising inflation and there was nonetheless an assumption that it will come again to focus on with solely modest will increase in rates of interest.

“Historical past means that upon getting acquired an inflation downside there's various financial ache you must undergo to eliminate it,” King added.

For Tasker, the scenario is difficult by Brexit, as increased transport prices and delays make it more durable to promote to clients within the EU. Throughout the coronavirus pandemic she had benefited from booming home demand, though that's drying up.

“I’ve seen a drop in gross sales for the reason that information introduced there can be vitality worth will increase. It’s not simply me, it’s throughout the Fb teams I’m in with those that have small companies,” she mentioned.

“If folks aren’t spending, companies will shut. I’m undecided that’s useful for the economic system in any respect.”

Worries over the worldwide economic system have additionally risen this week, with information displaying eurozone manufacturing output development stalled in April, whereas China’s manufacturing facility exercise contracted at a steeper tempo as Covid-19 lockdowns hit industrial manufacturing and disrupted provide chains.

How different main economies are faring

US

The world’s largest economic system unexpectedly shrank within the first quarter. GDP fell 0.4% amid a weaker contribution from commerce and decrease authorities spending as Covid reduction was wound down. Inflation has hit 8.5%, the best in 4 a long time, placing stress on the Federal Reserve to lift rates of interest.

Eurozone

Progress slowed to 0.2% in January-March, from 0.3% within the fourth quarter of 2021. Germany recovered from a contraction within the last months of final 12 months however the French economic system stalled, Italy shrank and Spanish development slowed. Consultants warn the area is at heightened danger of inflation and financial slowdown from tensions with Russia amid the conflict in Ukraine, due to the reliance on gasoline imports.

China

The world’s second largest economic system is underneath stress as Beijing’s zero-Covid coverage has led to main cities being locked down in an try and comprise the unfold of Omicron, weighing on manufacturing facility output and shopper spending. The impression is predicted to ripple by international provide chains, hitting exercise in different nations. GDP grew 1.3% within the first quarter.

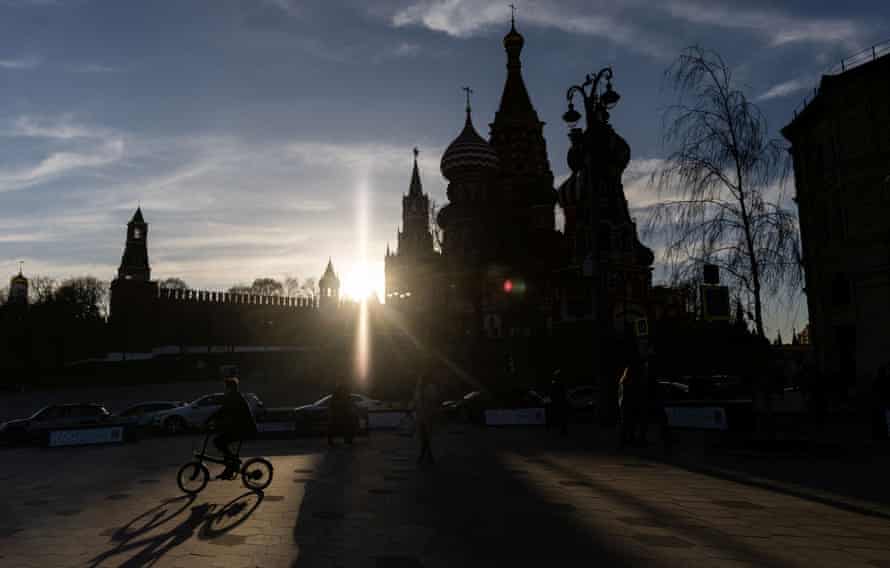

Russia

Russia is predicted to fall right into a deep recession this 12 months and subsequent as sweeping western sanctions imposed after Vladimir Putin’s invasion of Ukraine have an effect upon financial exercise. GDP is forecast to fall by between 8% and 10% in 2022, the most important annual drop since instantly after the collapse of the Soviet Union within the Nineteen Nineties. Inflation is predicted to hit as a lot as 23%.

Post a Comment