Before Sue Brown retired three years in the past, she felt burned out. At 67, she was juggling a busy job at a chauffeur firm and caring for her accomplice, Neil, who had extreme well being points. “I used to be taking bookings and managing drivers so I usually left the home at 4am,” she says. “I’ve labored since I used to be 15, however it turned an excessive amount of.”

In February this 12 months, Neil died. Two months later, Brown took a part-time job at a kitchen canteen in Dorking, Surrey, the place she lives. At first she was on the lookout for a distraction from her grief and a method to hold energetic, however as the price of dwelling soars, working has grow to be a necessity. “I wasn’t entitled to any allowances after I misplaced Neil. I’m dwelling within the cellular dwelling that he left me, however my pension solely provides me £720 a month.”

After meals, payments and council tax are accounted for, there isn't any spending cash left. Brown has to pay for a automotive as a result of the native bus service is proscribed. “I’m fairly fortunate as a result of I’m match, other than a little bit of arthritis, however I don’t know the way lengthy that may final for,” she says. She worries that rising gas payments may depart her unable to afford meals.

Though she want to be extra financially safe and feels the federal government must be doing extra to help individuals, she enjoys her job. “I principally clear the tables and do the washing up, amongst different duties. It’s a pleasant place to work and I get pleasure from being round individuals.” She additionally will get a sizzling meal on each shift, which helps to drive down the meals and cooking vitality payments. “I’ve at all times thrown myself into work, however now it’s preserving me alive too.”

Tales like Brown’s are so widespread that they've impressed the phrase “the nice unretirement”. New figures from the Centre for Ageing Higher present that the variety of individuals aged 65 or over getting into the workforce rose by 173,000 within the first quarter of 2022. “This improve marks a giant bounce, after the pandemic put an enormous dent within the variety of individuals working of their 50s, 60s and past,” says Kim Chaplain, a specialist adviser for work on the organisation. “Though we don’t know the complete causes behind every individual’s determination, we suspect the rising value of dwelling is enjoying a task.”

In keeping with analysis from the Institute for Fiscal Research, funded by the centre, the rise within the state pension age from 65 to 66 led to a giant improve within the variety of individuals working at 65, and an excellent greater improve within the variety of 65-year-olds dwelling in absolute poverty. “People who find themselves already in a good job are in a position to hold on for an additional 12 months – however for a lot of who can’t entry work, one other 12 months with out the state pension simply means one other 12 months making an attempt to get by on insufficient working-age advantages,” says Chaplain.

Ian Dempsey, an impartial monetary adviser and pensions knowledgeable, says the looming monetary disaster may have a big impression on his purchasers. “Many individuals are fearful about when they may be capable to retire. Slightly than growing pension contributions, they're having to scale back them, which goes to have a knock-on impact.”

Information from the monetary providers firm Canada Life backs his observations, suggesting that one in 5 persons are decreasing pension contributions, with a one-year break costing savers as much as 4% of their whole fund. “Retirement is a really totally different idea now. You don’t cease any extra at 65 and put your toes up. It will get to the purpose the place individuals work so long as their well being permits, and solely retire in the event that they bodily can’t work,” provides Dempsey.

Remaining-salary pensions, which offered a assured earnings for all times based mostly in your last wage, are largely a factor of the previous within the personal sector. As a substitute people have grow to be answerable for managing their very own retirement financial savings. “Cash remains to be an enormous taboo on this nation and other people don’t get the suitable monetary recommendation and training on benefit from our financial savings,” says Dempsey. “Individuals are usually ashamed of their monetary scenario, too, particularly if they've been in debt or confronted monetary issues for any motive. We have to normalise these conditions and discuss them overtly.”

Bernadette Hempstead, who's in her early 70s, from Bury St Edmunds in Suffolk, felt embarrassed about her low earnings earlier than she not too long ago began a part-time job as a showroom ground assistant. Along with serving to in direction of payments, the additional cash is constructing her confidence and monetary safety after a interval of homelessness. “When the proprietor of the property I used to be renting died, I used to be despatched an eviction discover by her son,” she says. “I spent 9 months dwelling between the properties of assorted relations, in addition to hostels, earlier than I used to be lastly in a position to transfer right into a one-bedroom assisted-living flat in June.”

After retiring at 64 from workplace jobs in human assets, she started to obtain a small personal pension along with her state pension. These two pensions aren’t sufficient now to cowl her bills. “Even earlier than the disaster I used to be simply present, not dwelling,” she says. “As issues get costlier, it turned unimaginable. I had additionally worn out a whole lot of my financial savings through the interval I used to be homeless.”

The job has given Hempstead a brand new lease of life, and she or he is grateful that she will be able to work. “Residing in hostels confirmed me how many individuals aren’t effectively sufficient to work. It has allowed me to begin shopping for small luxuries once more. I purchased some footwear within the gross sales this week. I can’t keep in mind the final time I purchased something new.”

Earlier than securing the job, she discovered it troublesome to be sincere with others about her monetary scenario. “You may’t even begin to think about what it’s like. I'd at all times say I didn’t like issues once I was out buying with pals, or that I wasn’t hungry after we went for lunch,” she says. “In actuality, I couldn’t afford to do this stuff. Now, I can get pleasure from a meal or a espresso, and put petrol within the automotive with out worrying.”

Although some older individuals benefited from decrease home costs and better financial savings charges earlier than the 2008 recession, Hempstead’s story illustrates that this isn’t the case for everybody. The Centre for Ageing Higher believes the disaster will likely be particularly troublesome for individuals who have made fragmented pension contributions previously, as a consequence of incapacity, sickness or taking day off for childcare. “There are many individuals who keep in and return to work as a result of they need to keep energetic. We're involved about these with disabilities and well being circumstances who may push themselves into unsuitable work reasonably than attempt to survive on advantages,” says Chaplain.

It may be troublesome to entry help to return to work if you're not claiming common credit score, she says: “Our analysis exhibits there's a huge stigma round this, and accessing authorities providers typically, amongst this age group. Some discover the system complicated and troublesome to navigate – and so keep away from these routes to help altogether.”

Getting again into paid work after a protracted break is troublesome for different causes, too, together with age discrimination. Tony, 78, from Southampton, believes he has confronted ageism in his seek for a job. “I used to be a supply driver with Royal Mail till I used to be 65. I didn’t need to depart, however I used to be made to retire,” he says. Since then he has stored himself busy with voluntary roles, most not too long ago as a befriender for Age UK, the place he primarily helps veterans.

He's on the lookout for a job to pay for the petrol, in order that he can proceed doing the voluntary work he loves. “I need to be part-time as a result of I've grandparent duties in order that our children can get to work,” he says. “However as quickly as you point out that you're 78 years previous, the roles market all of the sudden goes chilly. I received into an company however now I’m being inundated with 100 emails a day for jobs that aren’t associated to what I would like. I discover it irritating.”

Though Tony has labored all his life, his pension isn’t big. “I used to be going to hitch the military once I was younger however I developed tuberculosis,” he says. He made a full restoration and joined the Territorial Military six years later, however that didn't entitle him to a military pension. “I used to be solely at Royal Mail for 10 years so didn’t have time to construct up a giant pot, however I at all times landed on my toes.” In the intervening time, Tony is extraordinarily match and wholesome for his age, and eager to search out driving or warehouse work. “I've dyspraxia and dyslexia so an workplace job isn’t for me. I actually need one thing the place I can keep energetic.”

Stuart Lewis, the founder and CEO of Relaxation Much less, a digital group that helps the over-50s, says ageism within the office begins on the age of 55, and will get steadily worse as individuals become older. “We frequently discuss it because the final acceptable type of prejudice,” he says. Although demand for sure areas of labor, together with care, HGV driving and professional providers, stay pretty excessive, these with out specialist abilities face obstacles. “It’s laborious to have knockback after knockback, so we at all times advocate taking time for self-care so you'll be able to strategy interviews in a optimistic method. We additionally counsel taking your age off your CV, in addition to training and early work expertise dates. It’s not related and means individuals can immediately age you.”

Whereas Moore, Hempstead and Brown have relied on conventional routes to search out paid work, others are in search of inventive methods to make more money and sidestep ageism. Dorothy (not her actual title), 67, is renting out rooms in her Twickenham dwelling to individuals working within the movie business. “I'm primarily a chambermaid for individuals who keep,” she says. “I'm fortunate to personal my dwelling and have two rooms I can lease out. We're near a number of studios, so it’s a well-liked location for individuals to remain. I'm washing sheets and towels, and ensuring the rooms are clear and tidy for every new arrival.” She retired after she was placed on furlough from her job at Costco initially of the pandemic, however is now having fun with the additional earnings her facet hustle brings.

“While you retire, you might be just about on a hard and fast earnings, so you might want to be far more cautious with cash,” she says. “I've stopped going to the hairdresser and getting my nails executed, which I used to like.” She admits that it's worrying to have to consider issues that must be reasonably priced. “I used to make a superb dwelling by means of a curtain enterprise however that’s laborious, bodily work and every decade you get weaker. I really feel I ought to be capable to sit again and revel in life a bit bit, however I'm terrified of the mounting payments.”

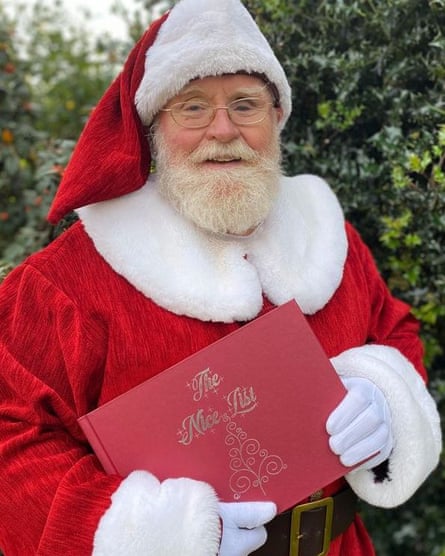

Mike Facherty, 71, from Studying, loved a profitable profession in IT till he retired 12 years in the past. Regardless of a beneficiant pension and proudly owning his dwelling, he's struggling to maintain up with rising prices. He runs storytelling occasions at native faculties to cowl the payments. “Since retiring, I’ve executed odd bits of performing work and have had common gigs as Father Christmas at a grotto in Bracknell,” he says. However the seasonal work is not sufficient to cowl the whole lot. “I need to pay for payments but in addition the odd luxurious. We don’t exit for dinner a lot or have overseas holidays, however typically we like a takeaway.”

Fortunately, Facherty loves what he does. “It helps kids to develop literacy abilities, self-confidence and empathy, which is admittedly rewarding, in addition to bringing in more money.” However for a lot of of his pals and acquaintances, the scenario is much less vivid. “I feel lots of people are embarrassed that they're having to return to work, so that they gained’t discuss it. But it surely’s taking place in all places,” he says.

As the price of dwelling bites, Lewis’s largest issues are for older individuals who don’t personal property and don’t have substantial pension pots. “The state pension rose by 3% this 12 months, which was nowhere close to according to the 9% inflation rise on the time,” he says. With ONS knowledge already displaying a nine-year hole in life expectancy and an 18-year hole in wholesome life expectancy between essentially the most and least prosperous teams, inequality may worsen if steps aren’t taken to guard these on decrease incomes.

“Though many individuals return to work as a result of it improves their wellbeing, others haven't any selection,” says Lewis. “Individuals who want help can not depend on the federal government and it erodes confidence. After working their entire lives, individuals don’t know if they are going to be entitled to assist.”

Post a Comment